The Single Strategy To Use For Accounting Fresno

Wiki Article

8 Simple Techniques For Fresno Cpa

Table of ContentsThe 6-Second Trick For Certified AccountantUnknown Facts About AccountantsHow Fresno Cpa can Save You Time, Stress, and Money.Not known Incorrect Statements About Fresno Cpa

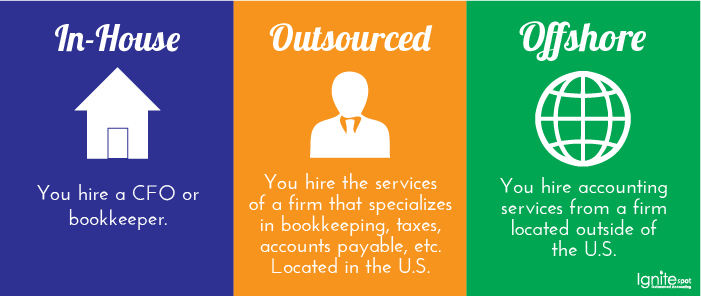

Getty Images/ sturti Outsourcing bookkeeping services can free up your time, prevent errors and also decrease your tax costs. Do you require an accountant or a certified public accountant (CPA)?

Little organization owners additionally assess their tax problem as well as stay abreast of upcoming changes to stay clear of paying more than essential. Produce monetary declarations, consisting of the equilibrium sheet, earnings and also loss (P&L), money circulation, and revenue statements.

Track job hours, compute wages, withhold taxes, problem checks to employees and make sure precision. Audit solutions might likewise consist of making payroll tax obligation payments. Additionally, you can hire consultants to develop as well as set up your accounting system, supply monetary preparation recommendations and also discuss monetary declarations. You can contract out chief monetary police officer (CFO) solutions, such as sequence planning as well as oversight of mergers and purchases.

The Main Principles Of Certified Cpa

Frequently, local business proprietors outsource tax obligation solutions initially and also add pay-roll assistance as their company expands. According to the National Small Organization Organization (NSBA) Local Business Taxation Survey, 68% of respondents make use of an external tax expert or accountant to prepare their company's tax obligations. In contrast, the NSBA's Innovation and Organization Study discovered that 55% of little business proprietors handle payroll online, and 88% take care of financial accounts digitally.Currently that you have a concept of what type of bookkeeping solutions you require, the concern is, who should you hire to supply them? While a bookkeeper handles information entry, a Certified public accountant can speak on your part to the IRS as well as offer economic recommendations.

Prior to deciding, think about these inquiries: Do you desire a neighborhood audit professional, or are you comfy functioning practically? Does your company need sector expertise to carry out audit jobs? Are you looking for year-round support or end-of-year tax obligation administration services?

:max_bytes(150000):strip_icc()/accounting-cycle-4202225-55b4e93d325f490aa6e7bd3a13fd1304.jpg)

Getting The Accountants To Work

Expert organization advice, news, and trends, delivered weekly By authorizing up you accept the carbon monoxide Privacy Policy. You can decide out anytime. Published November 30, 2021.

In the United States, the certified public accountant designation is accounting fresno regulated by individual state boards of book-keeping. To end up being a CPA, a private typically requires to complete a specific number of university training course credits in accountancy and also business-related topics, obtain a specific amount of practical experience in the area, and also pass the Attire Cpa Examination (CPA Exam).

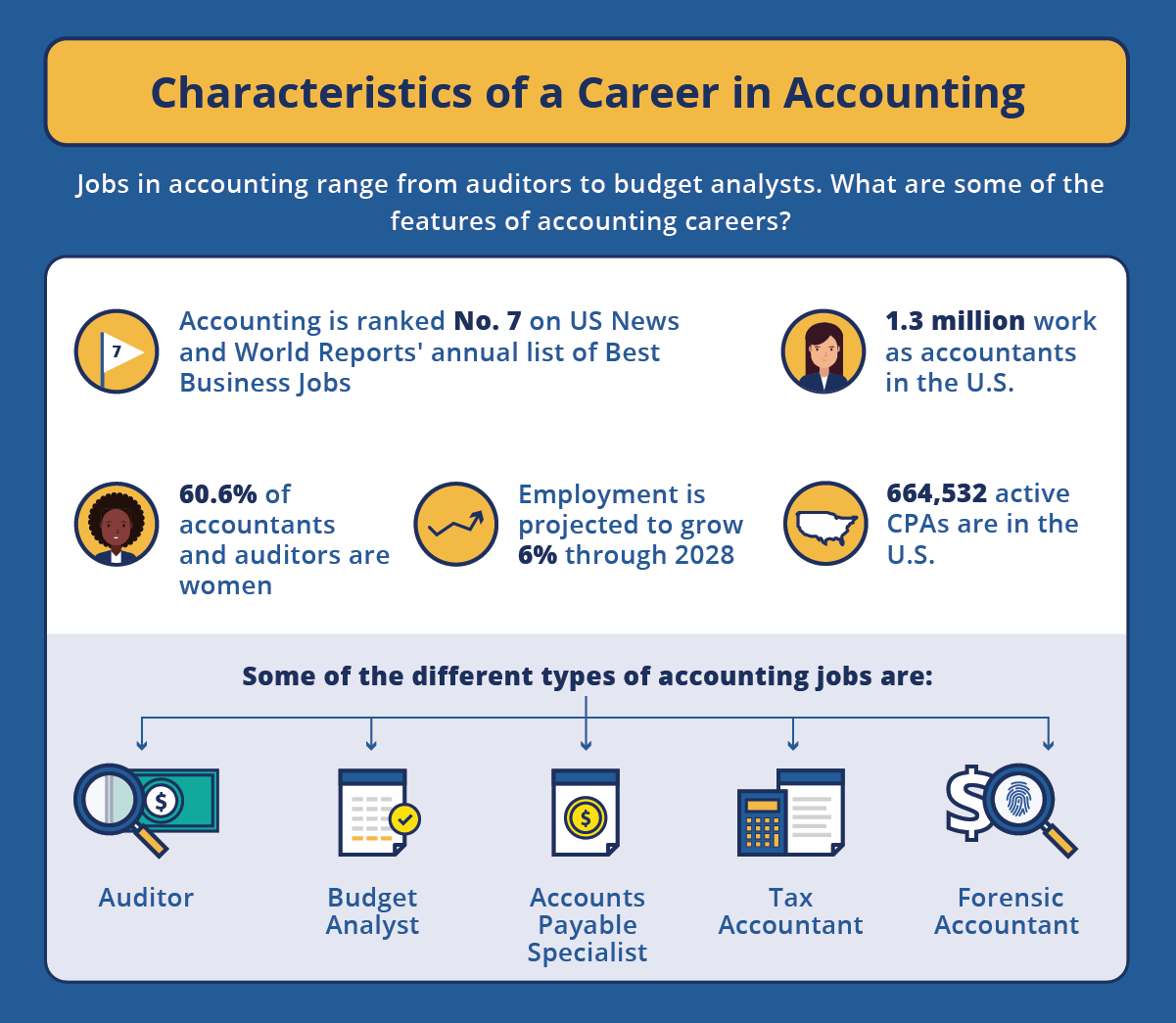

Management or supervisory accounting professionals utilize monetary info to help organizations make notified organization choices. They are liable for giving economic data as well as analysis to supervisors as well as establishing as well as carrying out financial systems and controls.

Certified Cpa Fundamentals Explained

They may be entailed in tasks such as preparing financial records, establishing budgets, examining financial information, and producing monetary designs to aid supervisors make informed decisions about the organization's operations and also future direction. Unlike accountants, who typically collaborate with a wide variety of clients and also concentrate on outside financial coverage, administration accounting professionals work mostly with the monetary information of a single organization.

A Chartered Accountant (CA) is a specialist accountant who has fulfilled specific education as well as experience demands and has actually been given an expert accreditation by an acknowledged accounting body. Chartered Accountants are frequently considered among the highest possible level of expert accounting professionals, as well as the CA designation is identified and also respected worldwide. To end up being a Chartered Accountant, a private commonly needs to finish a certain degree of education and learning in accountancy and also related subjects, obtain a certain quantity of practical experience in the field, and also pass a professional qualification exam.

A number of various professional bookkeeping bodies provide the CA classification, consisting of the Institute of Chartered Accountants in England as well as Wales (ICAEW), the Institute of Chartered Accountants of Scotland (ICAS), and the Institute of Chartered Accountants in Ireland (ICAI). The requirements and also procedures for coming to be a Chartered Accounting professional differ relying on the details professional body (certified accountant).

Report this wiki page